S&P Global’s New Nature Risk Profile Dataset Helps Companies Understand Their Impacts and Dependencies on Nature

S&P Global has launched Sustainable1, a new dataset that assesses nature-related impacts and dependencies across a company’s direct operations. The Nature & Biodiversity Risk dataset provides a number of new nature-related risk metrics, including a dependency score and an ecosystem footprint measure, enabling greater understanding of a company or asset’s dependency and impact on nature.

The dataset covers over 17,000 companies and over 1.6 million assets, and can be accessed through S&P Capital IQ Pro. The dataset applies the Nature Risk Profile, a new methodology for analyzing companies’ impacts and dependencies on nature, launched by S&P Global Sustainable and the UN Environment Programme in January.

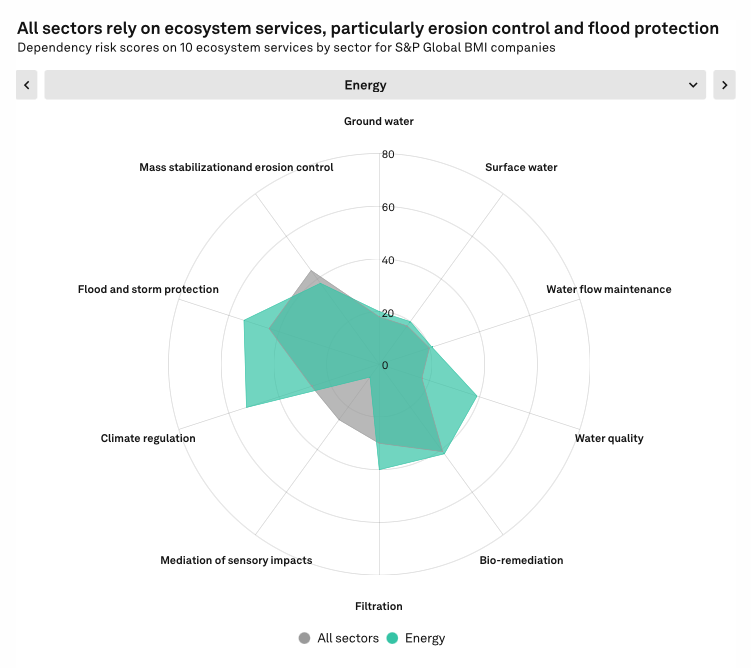

The dependency score considers the level of reliance that a business’ direct operations have on 21 different ecosystem services, as well as the expected resilience risk of the ecosystem providing these services, where these businesses are operating around the world. The dependency score is on a scale from 0 to 1.0 (where 0 represents no dependency risk and 1.0 represents very high dependency risk).

The Ecosystem Footprint measures a business’ direct operational impact on nature and biodiversity. This metric combines three key areas of analysis: the areas of land impacted by the company (land area), the degree to which the location-specific ecosystem integrity is reduced (ecosystem degradation) and the significance of the location-specific ecosystem impacted (ecosystem significance).

Overall,

“Our research shows that 85% of the world’s largest companies have a significant dependency on nature, indicating the critical importance of greater transparency for market participants on nature-related risks and opportunities. This new dataset signals a maturation of the conversation on nature and provides clear metrics quantifying the nature-related dependency and impact of over 1.6 million global real assets,” said Steve Bullock, Global Head of Research and Methodology, S&P Global Sustainable.

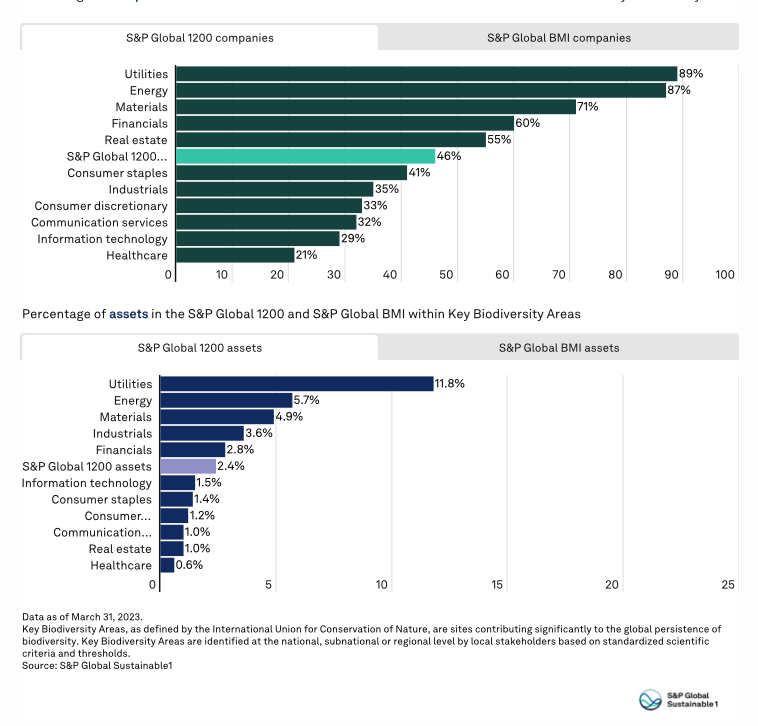

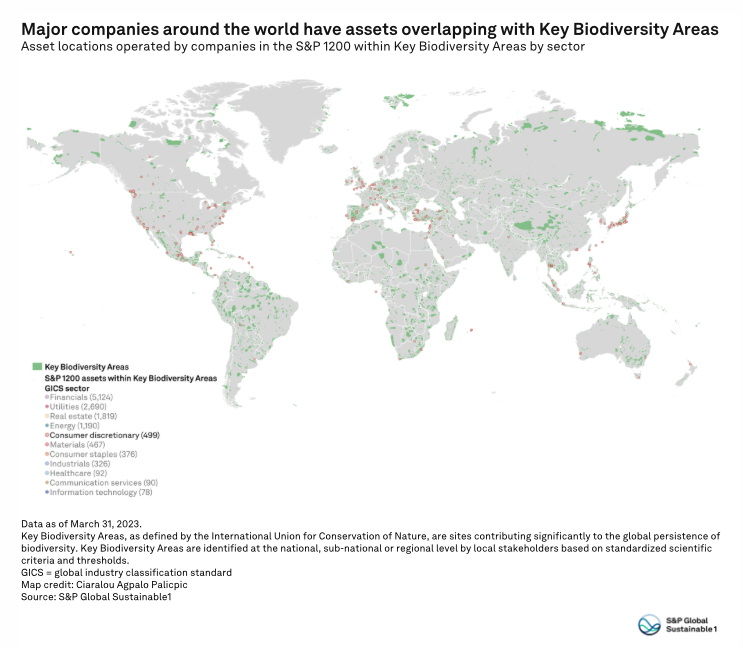

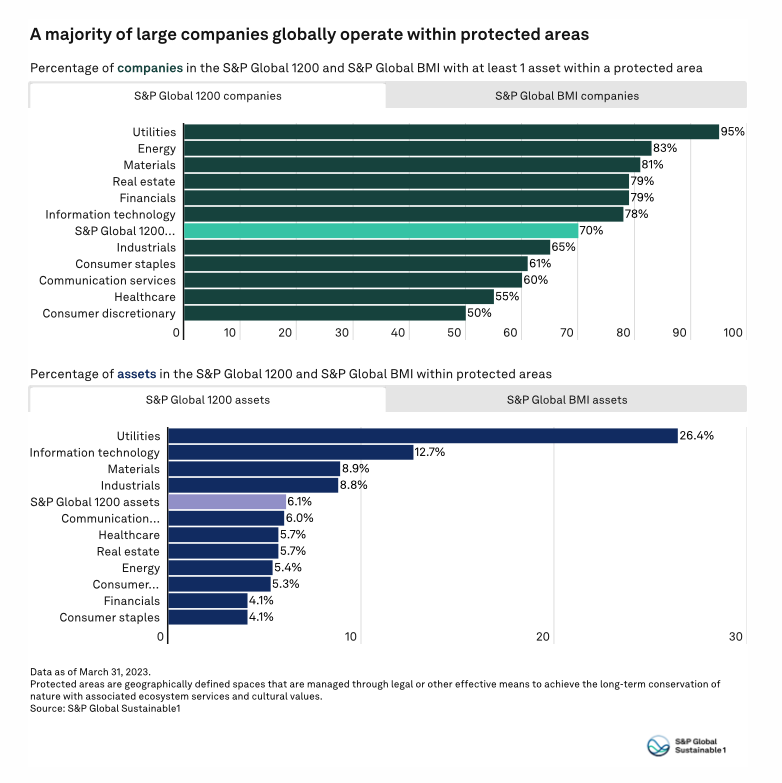

Applying this new dataset to the S&P 1200, the world’s largest public companies, the analysis shows that 85% of the world’s largest companies have a significant dependency on nature across their direct operations, and 46% of the world’s largest companies have at least one asset located in a Key Biodiversity Area that could be exposed to future reputational and regulatory risks.

S&P 1200 companies used an estimated 22 million hectares of land for their direct operations in 2021 to generate USD 28.9 trillion revenue. Expressed as an ecosystem footprint, this is equivalent to fully degrading 2.2 million hectares of the most pristine and significant ecosystems globally, such as the most intact and biodiverse parts of the Amazon or Sumatran rainforests.

The dataset can be leveraged by market participants to understand their nature-related risks and to more transparently align with the recommendations of the Taskforce on Nature-related Financial Disclosures. The dependency score and ecosystem footprint methodology notes show how the dataset is calculated.

The key benefit is that the new dataset will support companies, investors and other entities as they seek to understand, manage and mitigate exposure to nature-related risks and impacts. While there are several reporting frameworks and standards for Environment, Social, and Governance (ESG) and Corporate Social Responsibility (CSR) reporting, there is currently no universal or mandatory standard.

However, some commonly used reporting frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). Additionally, some countries have specific regulations and guidelines for ESG and CSR reporting that companies operating in those jurisdictions must follow.

S&P Global Sustainable1 should be complementary established reporting frameworks. Fundamentally, it should be a key resource in helping companies of all sizes to understand their nature-related impact and risks.

CleanEarth Media

Popular Now

More From Clean Earth